Home > Blog

Read Time — 9 minutes

The Importance of Budget Planning in Construction Project Management

Effective budget planning is a cornerstone of project success in residential construction. Without a well-structured budget plan, even the most meticulously designed projects can face financial pitfalls that jeopardize their outcomes. Budget planning in construction is not just about keeping track of expenses; it’s a strategic process that aligns financial resources with project goals, ensuring that every dollar is spent wisely and effectively.

Imagine a construction project running smoothly, with financial resources allocated precisely where needed and unexpected costs easily handled. This level of financial control doesn’t happen by chance; it results from meticulous budget planning and management. By establishing a solid financial foundation from the outset, construction professionals can navigate the complexities of budgeting, mitigate risks, and achieve project goals without compromising on quality or deadlines.

This article delves into the critical aspects of budget planning in construction project management. We’ll explore the key benefits of effective budgeting, the common challenges faced, and the strategies that can be employed to enhance financial oversight. Additionally, we’ll examine how modern project management software can revolutionize budget planning, offering real-time tracking and insightful financial analysis.

Introduction to budget planning in project management

Overview of budget planning and its significance in project management

Budget planning is a critical process in construction project management that involves creating a financial roadmap for a project. This process ensures that all financial goals are met, and resources are allocated efficiently. Effective budget planning helps keep business expenses in check and provides a clear picture of the project's financial health.

Benefits

- Provides a financial roadmap for the project

- Ensures financial goals are met

- Improves resource allocation and minimizes waste

Techniques to improve

- Conduct a thorough initial project assessment to identify all potential costs

- Involve key stakeholders in the budgeting process to ensure all perspectives are considered

- Use historical data from past projects to inform budget estimates

The impact of effective budgeting on project success

Effective budget planning has a profound impact on the success of construction projects. By establishing a solid budget plan, project managers can track spending, manage variable expenses, and ensure that projects are completed on time and within budget. This proactive approach minimizes the risk of financial overruns and maximizes resource utilization, leading to successful project outcomes.

Benefits

- Enhances project success rates by minimizing financial overruns

- Maximizes resource utilization

- Provides a clear financial picture for stakeholders

Techniques to improve

- Implement regular budget reviews and updates throughout the project lifecycle

- Use advanced budgeting tools and software for real-time tracking

- Establish a contingency fund to handle unexpected expenses

Key benefits of budget planning

Enhancing financial control and decision-making

Budget planning provides a structured approach to managing financial goals and business expenses. It allows project managers to use budgeting to make informed decisions and allocate resources more effectively. This control helps maintain spending categories and ensures discretionary spending is aligned with project objectives.

Benefits

- Provides a structured approach to managing financial goals

- Enables informed decision-making

- Keeps business expenses in check

Techniques to improve

- Use detailed financial planning tools to create comprehensive budget plans

- Regularly review and adjust the budget based on project progress and changes

- Train project managers in financial management best practices

Improving resource allocation and efficiency

A well-developed financial plan enables better resource allocation across various project phases. Project managers can identify fixed expenses and variable expenses by using budget calculators and tracking tools, ensuring efficient resource use and minimizing waste.

Benefits

- Ensures efficient use of resources

- Minimizes waste and overuse of materials

- Improves project timelines and outcomes

Techniques to improve

- Utilize resource management software to allocate resources effectively

- Conduct regular resource utilization reviews

- Implement a lean construction approach to minimize waste

Facilitating better communication with stakeholders

Clear budget plans facilitate transparent communication with stakeholders, providing them insights into the project's financial status. This transparency builds trust and ensures all parties align with the project's financial goals and objectives.

Benefits

- Builds trust and transparency with stakeholders

- Ensures alignment on project financial goals

- Enhances stakeholder engagement and satisfaction

Techniques to improve

- Use project management software to share budget plans and updates with stakeholders

- Hold regular meetings to discuss budget status and address concerns

- Provide detailed financial reports to stakeholders

Challenges in project budget planning

Common obstacles and how to overcome them

Construction budget planning often faces challenges such as inaccurate cost estimation, unexpected variable expenses, and irregular income streams. Overcoming these obstacles requires a robust budgeting process that includes regular reviews and adjustments to the budget baseline.

Benefits of overcoming obstacles

- Reduces the risk of budget overruns

- Improves project outcomes and financial health

- Enhances project manager confidence and competence

Techniques to improve

- Conduct risk assessments to identify potential budget challenges

- Develop a detailed contingency plan for unforeseen expenses

- Use scenario planning to prepare for various financial outcomes

The role of contingency planning in budget management

Contingency planning is essential in managing budget uncertainties. By setting aside funds for unforeseen expenses, project managers can ensure that projects remain on track even when unexpected costs arise.

Benefits

- Provides a safety net for unexpected expenses

- Ensures project continuity despite financial surprises

- Enhances overall project resilience

Techniques to improve

- Allocate a specific percentage of the budget to a contingency fund

- Regularly review and adjust the contingency plan based on project progress

- Communicate the contingency plan to all stakeholders to ensure understanding and support

Strategies for effective budget planning

Techniques for accurate cost estimation and budget development

Effective budget planning starts with accurate cost estimation. Techniques such as analogous estimation, parametric estimation, and bottom-up estimation help develop realistic budget plans. These methods consider all aspects of the project, from labor and materials to fixed and variable expenses.

Benefits

- Ensures realistic budget expectations

- Reduces the risk of financial shortfalls

- Enhances project planning and execution

Techniques to improve

- Use a combination of estimation methods (analogous, parametric, bottom-up) for accuracy

- Involve experienced team members in the estimation process

- Utilize software tools for detailed cost estimation and budgeting

Best practices in budget tracking and management

Continuous tracking of spending categories and budget adherence is crucial for successful budget management. Implementing regular budget reviews and using advanced budgeting tools can help maintain financial control and ensure projects are completed within budget.

Benefits

- Ensures continuous financial control

- Identifies potential budget issues early

- Enhances financial decision-making

Techniques to improve

- Implement regular budget reviews and updates

- Use project management software for real-time budget tracking

- Establish clear financial reporting procedures and metrics

How project management software enhances budget planning

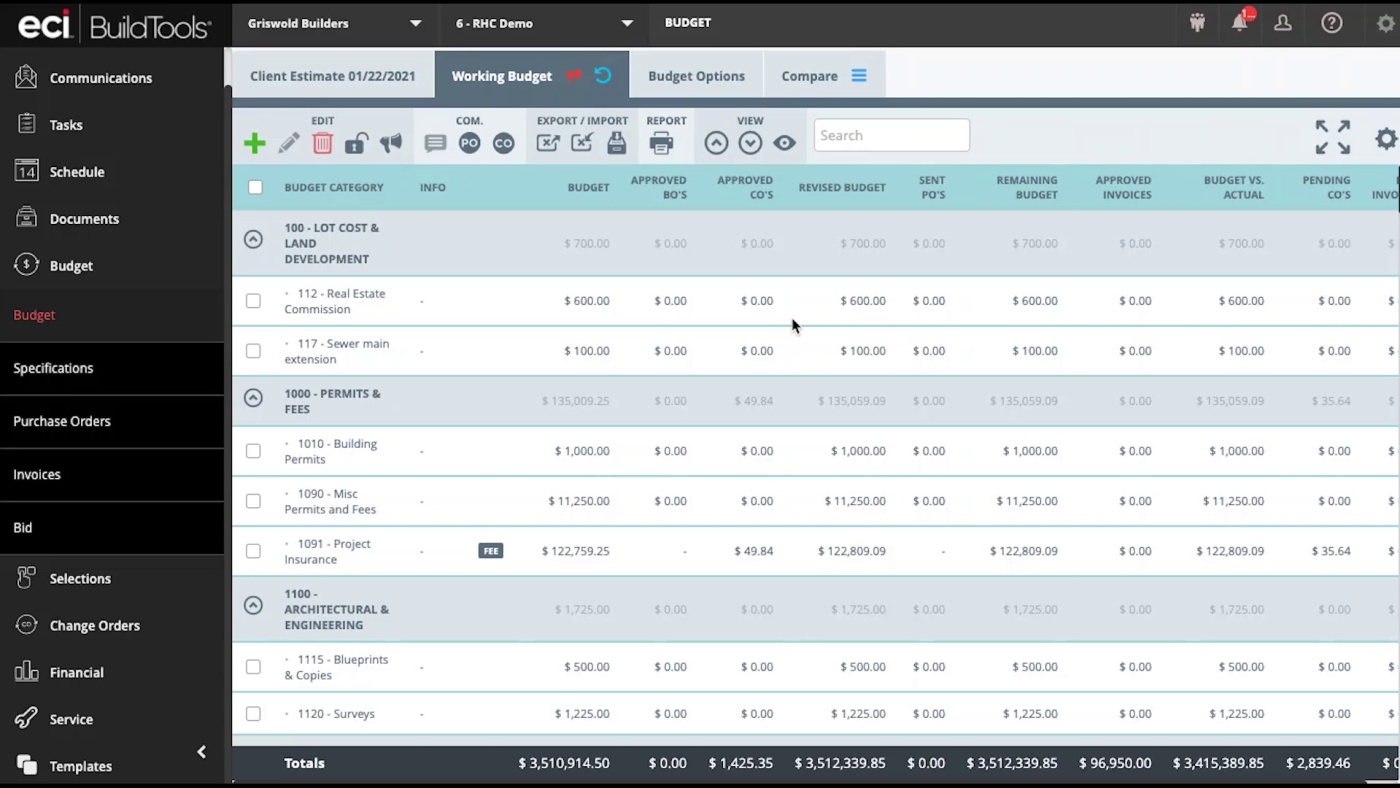

Real-time budget tracking

Project management software like BuildTools provides real-time budget tracking, allowing project managers to monitor expenditures and adjust as needed. This feature ensures that spending is aligned with the budget plan and helps prevent cost overruns.

Benefits

- Provides up-to-date financial information

- Enables timely adjustments to the budget

- Improves overall financial control

Techniques to improve

- Integrate budget tracking software with other project management tools

- Train project managers in the use of real-time tracking features

- Use dashboards and reports to monitor budget status easily

Variance analysis and financial forecasting

Using project management software, project managers can conduct variance analysis to compare actual costs with budgeted costs. This analysis helps identify deviations and implement corrective actions. Financial forecasting features enable better planning for future projects by providing insights into spending trends and patterns.

Benefits

- Identifies deviations from the budget

- Provides insights for future budget planning

- Enhances overall project financial health

Techniques to improve

- Regular variance analysis will be conducted to compare actual costs with budgeted costs

- Use financial forecasting tools to predict future expenses and revenues

- Adjust budget plans based on variance analysis findings

Improving financial decision-making

Automation technology in project management software enhances financial decision-making by providing accurate and timely data. This technology helps create detailed financial reports, track spending, and ensure that business processes align with financial goals.

Benefits

- Provides accurate and timely financial data

- Enhances strategic planning and resource allocation

- Improves project outcomes and financial performance

Techniques to improve

- Use automation technology to streamline financial data collection and analysis

- Implement decision-support tools to provide insights and recommendations

- Train project managers in financial analysis and decision-making best practices

BuildTools budgeting demo

Conclusion

Budget planning is an essential aspect of construction project management that ensures projects stay on track financially, enhancing their overall success. By implementing effective budget planning strategies, construction professionals can achieve better financial control, improve resource allocation, and facilitate transparent communication with stakeholders.

Overcoming common budget planning challenges and leveraging advanced project management software can significantly enhance budget tracking, variance analysis, and financial decision-making. Ultimately, integrating robust budget planning practices into your construction projects not only mitigates financial risks but also drives business growth and sustainability.

Next steps plan

1. Conduct a thorough initial assessment

- Action: Gather all potential costs associated with your project, including fixed and variable expenses, to create a comprehensive budget plan.

- Benefit: This ensures that all financial aspects are considered initially, reducing the risk of unexpected costs.

2. Involve key stakeholders

- Action: Engage stakeholders in the budgeting process to gain different perspectives and ensure alignment on financial goals.

- Benefit: This promotes transparency and builds trust, facilitating better communication and decision-making throughout the project.

3. Use historical data

- Action: Analyze data from past projects to inform your budget estimates and identify areas for improvement.

- Benefit: Leveraging historical data can provide more accurate cost estimates and highlight potential risks based on previous experiences.

4. Implement regular budget reviews

- Action: Schedule periodic budget reviews to track progress, identify variances, and make necessary adjustments.

- Benefit: Regular reviews ensure continuous financial control and early detection of potential issues, allowing timely interventions.

5. Develop a contingency plan

- Action: Allocate a specific percentage of your budget to a contingency fund to cover unforeseen expenses.

- Benefit: A contingency plan provides a financial safety net, ensuring project continuity despite unexpected costs.

6. Utilize advanced budgeting tools and software

- Action: Integrate budgeting software with your project management tools for real-time budget tracking and financial forecasting.

- Benefit: Advanced tools enhance financial accuracy, improve decision-making, and provide up-to-date financial information.

7. Train project managers

- Action: Provide training for project managers on financial management best practices and budgeting tools.

- Benefit: Well-trained project managers can effectively oversee budget planning, tracking, and adjustments, ensuring better financial outcomes.

8. Conduct variance analysis

- Action: Regularly compare actual and budgeted costs to identify deviations and understand their causes.

- Benefit: Variance analysis helps refine budget estimates and improve future financial planning.

9. Implement decision-support tools

- Action: Use decision-support tools to analyze financial data and provide insights and recommendations.

- Benefit: These tools enhance strategic planning and resource allocation, leading to better financial performance.

10. Communicate with stakeholders

- Action: Regularly share budget plans, updates, and financial reports with stakeholders.

- Benefit: Clear communication builds trust, keeps stakeholders informed, and ensures alignment on financial objectives.

By following these steps, you can improve your budget planning processes, reduce financial risks, and enhance the overall success of your construction projects. Implementing these strategies will help you achieve better financial control, optimize resource allocation, and facilitate transparent communication with stakeholders, ultimately driving business growth and sustainability.

Optimize project management in construction

Discover our construction project management software, BuildTools, to improve budget planning and financial outcomes on your new custom home and remodeling projects.